expert nvestment management

Social Security and Pension Optimization

business financial planning

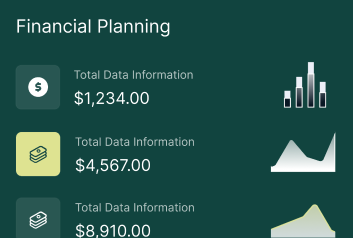

We are committed to guiding businesses and individuals through the financial landscape with clarity and confidence. Leveraging years of expertise in financial planning, investment management, and business consulting, we turn complexity into opportunity.

Our experienced team delivers reliable insights and strategies, ensuring your financial decisions are well-informed and secure.

Our personalized solutions are crafted address your unique financial helping you achieve your specific goals and aspirations.

Our proven track record highlights successful outcomes and client satisfaction through effective financial solutions.

Our specialized financial services are designed to align with your specific objectives, offering strategic guidance and insights to drive informed decision-making and sustainable growth.

Our seasoned consultants deliver deep industry knowledge and practical strategies, optimizing operations and catalyzing sustainable expansion for your business.

Empower your financial journey with expert advice, personalized strategies, and solutions designed to help you achieve long-term stability, growth, and peace of mind.

expert nvestment management

Social Security and Pension Optimization

business financial planning

Empower your business journey with expert advice, personalized strategies, and solutions designed to help you achieve long-term stability, growth, and peace of mind.

expert nvestment management

Social Security and Pension Optimization

business financial planning

Empower your risk journey with expert advice, personalized strategies, and solutions designed to help you achieve long-term stability, growth, and peace of mind.

expert nvestment management

Social Security and Pension Optimization

business financial planning

Empower your investment journey with expert advice, personalized strategies, and solutions designed to help you achieve long-term stability, growth, and peace of mind.

expert nvestment management

Social Security and Pension Optimization

business financial planning

Our team of experienced professionals delivers personalized, results-driven financial strategies tailored to your unique goals. We prioritize transparency, trust, and long-term success.

We believe that a successful financial journey starts with understanding your unique needs and aspirations Our approach is built on a foundation of collaboration, transparency, and expertise.

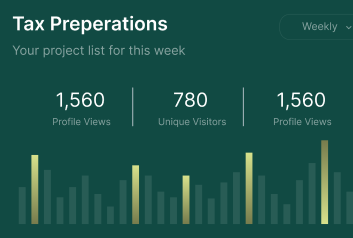

Explore fun and surprising facts about the financial world. Learn how history, trends, and innovations have shaped today's finance landscape, making it easier to navigate your financial journey.

Crafting tailored strategies to align with individual financial objectives.

Professional oversight to optimize investment portfolios for growth and risk mitigation.

Guidance on property investments for income generation and capital appreciation.

Discover our competitive pricing structure designed to provide accessible financial services without compromising quality. Empower your financial future today.

personal

Essential financial tools for individuals starting their wealth journey.

business

Strategic financial planning to optimize business operations and maximize profitability.

premium

Exclusive wealth management services for high-net-worth individuals and large estates.

Start your journey toward financial success with expert guidance and personalized solutions. Secure your future with confidence.

The first credit card ever issued was made of cardboard and was introduced.

we believe that you should keep more of what you earn.

To create a business budget, start by estimating your income and listing all fixed and variable expenses. Subtract expenses from income.

Cash flow refers to the movement of money in and out of your business. Positive cash flow ensures you can cover operational costs.

Build financial stability by maintaining a strong cash reserve, cutting unnecessary costs, managing debt carefully.

Key financial metrics include net profit margin, cash flow, operating expenses, debt-to-equity ratio, and return on investment (ROI).

You should review your budget monthly or quarterly to ensure you're on track with projections. Regular reviews help.

FinTech solutions can streamline financial operations through automation, improve data accuracy, enhance decision-making.

Discover effective strategies to enhance your business's financial growth. From smart budgeting to investment tips, this post covers essential insights to help you improve profitability and achieve long-term success.